IndusInd Free Online Savings Bank – IndusInd Bank Limited is an Indian new generation bank in Pune, established in 1994. The bank offers commercial, transactional and electronic banking products and services. IndusInd Bank was inaugurated in April 1994 by then Union Finance Minister Manmohan Singh.

IndusInd Bank is now Offering Free Insta-Fund Online Savings Bank Account for Free. You can open this account online within 5 minutes with just your Aadhar Number & PAN Number. Its as simple as ABC, Try Now.

They will offer you All Major Banking Services, Like Mobile Banking, net Banking (IMPS, NEFT, Etc), UPI Access & Free Visa Virtual Card. You can also opt for a Platinum Debit Card with many offers at just Rs.249+gst per annum cost. Its a Nominal Charges Guys!!

IndusInd Bank Account Benefits:

- Free Zero Balance Account

- Online Open Account Easily in 5 Minutes

- Get Upto 7% Interest Rate

- Free Virtual Card, Mostly Working On All Major Shopping Sites

- Zero Maintenance Charges On Your Money

- Exciting Discount offers on BigBasket, Swiggy Etc Brands

- Free Mobile Banking & Internet Banking Facility

- UPI / Money Transfer Services for Free

- Free Rs.200 Welcome Bonus in IndusMobile App

- Free Rs.250 Voucher when you pay 1st time using Samsung Pay

Also Check: CountryDelight: Free Rs.500 On your 1st Deposit (Order Milk for Free)

Requirements for IndusInd Online Bank

- PAN Card

- Aadhaar Card

How to Open IndusInd Free Online Savings Bank?

- First, Click on Below Link & Goto IndusInd Bank Site

- Enter your Mobile Number first, You can choose your Own Account Number

- 1) Basic Details- Fill in details i.e. Name, Email id, contact number > Verify OTP

- 2) Documents- Add aadhar details & OTP confirmation

- 3) Personal Details- Now on the Next page add Pan Number, salary, Occupation, FATCA declaration

- There will be basically 4 options, fill them one by one

- Enter Your Pan Card number and Proceed next

- In FATCA click Yes and continue.

- In Occupation select – Student or Self Professional and continue.

- In Sallary- select 3+ lakh range and Proceed Next.

- Material Status- SINGLE, enter Parents detail and Proceed

Tip : If saying, Pin not serviceable, then Add a separate communication address with any of your nearest city pin and random address details.

- Now Choose Account Type As – Insta Funding Account (Which shows Rs.20000 Deposit)

- Choose Card as Platinum Card (Rs.249/p.a.) – If you need else Just Complete Aadhar OTP Verification & Close the page

- You will get sms within 6 hours telling that your Account is now activated!

- Enjoy Free Rs.0 Balance Account in IndusInd Bank

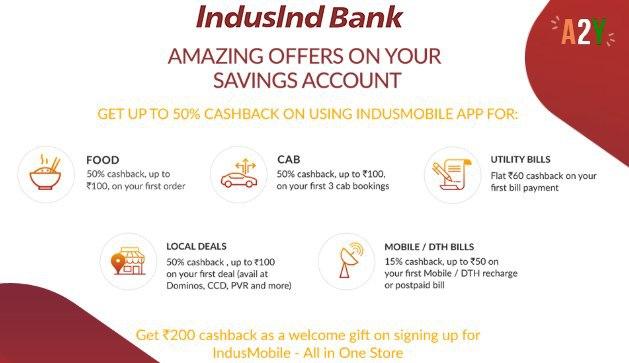

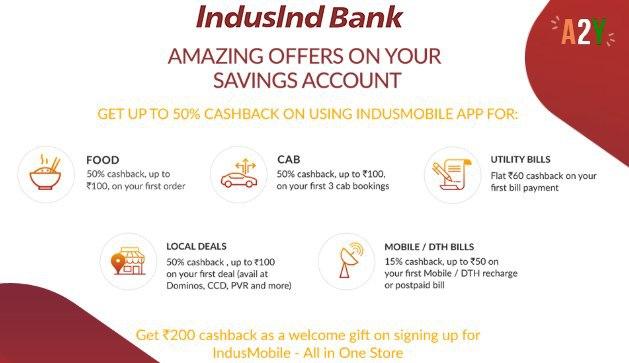

Welcome Offers on IndusInd Online Bank

Enjoy Attractive offers with your New Induslnd Bank Account. Open Free Account now!!

✅ Get Rs.200 Cashback as Welcome gift on Signing up for IndusMobile -All in One Store

1️⃣ Food – 50% upto Rs.100 on 1st order

2️⃣ Cab – 50% upto Rs.100 on 1st 3 Cab Booking

3️⃣ Utility Bills – Flat Rs.60 Cashback on your 1st Bill Payment

4️⃣ Local Deals – 50% CB upto Rs.100 on your 1st Deal (PVR, dominos, ccd & more)

5️⃣ Mobile/DTH Bills – 15% Cashback upto 1st Mobile/DTH or Postpaid bill

FAQs Regarding IndusInd Bank Account :

Q. Is it Zero Balance Savings Account?

A. Yes, but you require to Make an Initial Deposit + Opt for Debit Card (2 Variants are there for that)

a) Initial funding of 20,000 + Titanium Card @ Rs 249

b) or Buy a Platinum Plus Debit card worth Rs 1200 plus GST at the time of account opening

Q. Renewal Charges of Card?

A. Renewal charges will be the same as the initial charges you pay for the card, Eg: Titanium card at Rs.249+gst (Yearly fee)

Q. How much money i can deposit in this account?

A. The total balance in this account cannot be more than Rs 1 Lacs at any point in time and the aggregate credits cannot be more than 2 Lacs till face to face KYC is completed. Once KYC is completed there are no restrictions on the account.

Q. Documents Required to Open?

A. All you require is your Aadhaar Number and PAN. You should be carrying your registered mobile number linked with Aadhar while opening